At TradeWinds, we believe retirement planning should feel less like a guessing game and more like designing your next great adventure. Whether you’re a decade out or already hearing retirement whispers in your inbox, one thing is always true: the key to retiring with confidence is knowing where you stand and having a plan that supports where you want to go.

But here’s the thing, we know it’s not always easy to talk about. Retirement planning can feel heavy. Between the rising cost of living, medical expenses, and market uncertainty, it’s no wonder that outliving your money is one of the top financial fears in America. And yet, the best way to calm that fear is with clarity.

That’s what this month’s Money Courage is all about, giving you that clarity, one step at a time.

The Reality of Retirement—And Why It’s Worth Talking About

Let’s start with the facts.

According to Fidelity, a 65-year-old retiring this year can expect to spend roughly $165,000 just on out-of-pocket medical costs over the course of retirement. That number doesn’t include long-term care, dental, or the “what-if” moments that life inevitably throws at us.

On top of that, the average retirement now lasts between 20 to 30 years—longer than many people expect. That means your savings don’t just need to get you to retirement… they need to get you through it.

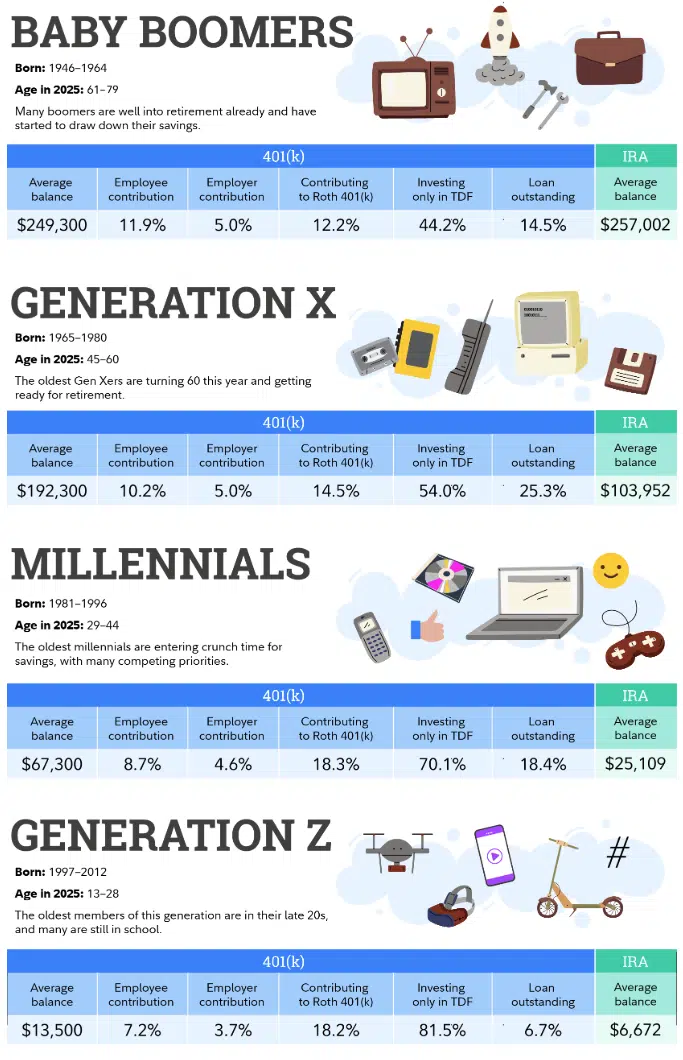

Despite all of this, nearly 40% of Americans haven’t taken steps to determine how much they’ll need to retire comfortably. And we get it. The landscape is complex. The calculators can be confusing. And for many people, it’s easier to say “I’ll deal with it later” than to stare down the unknown.

But the truth? Later has a funny way of sneaking up on us.

✅ Your Retirement, Ready for Review

Retirement planning isn’t just about saving enough. It’s about knowing how everything fits together, your income, your lifestyle, your health care, and your legacy.

That’s where our Retirement Readiness Checklist comes in.

It’s not a pop quiz. It’s a thoughtful guide to help you reflect, reassess, and prepare whether retirement is five years away or fifteen.

Retirement readiness is a combination of accounting for the ‘knowns’ along with planning for the unknowns. Consider the following concepts; are you ready for this next step?

It’s clear, simple, and built to move at your pace.

👉 Download the Checklist and start turning someday into a real plan.

Planning with Confidence, Not Perfection

At TradeWinds, we believe retirement planning isn’t about having everything perfectly mapped out from Day One. It’s about building a flexible, intentional plan that evolves with your life.

Some months you’re contributing more. Some months you’re catching your breath. That’s okay. Confidence doesn’t come from perfection it comes from progress and from having the right tools, mindset, and support.

Our team is here to help translate your vision into a plan, whether that means walking through your current 401(k), exploring health care savings strategies, or stress-testing your projected income for different retirement ages.

We don’t believe in “cookie-cutter” retirements, because there’s no such thing as a cookie-cutter life. Whether your dream is to travel, volunteer, open a second chapter career, or simply enjoy mornings without alarm clocks, your plan should reflect that.

Pocket-sized Advice: HSA’s

Pocket-sized Advice: Traditional vs. Roth IRA’s

Final Thought: The Best Time to Plan Was Yesterday. The Second Best? Today.

If you’ve ever thought, “I should really figure this out,” you’re not alone. But here’s the good news: it’s not too late, and it doesn’t have to be complicated.

This month, we’re challenging you to take just one step: Take the quiz. Ask the question. Start the conversation.

We’re here to help you retire not just with enough money but with the peace of mind that comes from knowing you’re ready.

Let’s walk toward that future together.

Disclosure: Tradewinds, LLC is an investment adviser registered under the Investment Advisers Act of 1940. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Tradewinds cannot guarantee the accuracy of the information received from third parties. The opinions expressed herein are those of Tradewinds and may not actually come to pass.