February is all about love. But we’re not just talking about chocolates, flowers, or romantic dinners. There’s another relationship that deserves your attention, your relationship with money.

It’s one of the longest, most important relationships in your life. It affects your choices, your future, and even your closest personal relationships. Just like any relationship, it can be healthy, supportive, and strong—or it can be complicated, stressful, and full of bad habits.

The good news? You have the power to change it.

Understanding your relationship with money and learning how to nurture it can bring you closer to your financial goals, reduce stress, and help you feel more secure. In this edition of Money Courage, we’ll explore what your relationship with money says about you, how it affects your life, and what you can do to strengthen it.

Just like other relationships, your connection to money is shaped by your experiences, emotions, and beliefs. Behavioral finance studies how these emotions can affect our decisions—sometimes for better, sometimes for worse.

Consider your money habits:

- Do you save for the future, or do you live in the moment?

- Are you comfortable taking financial risks, or do you prefer security?

- Do you avoid money conversations, or are you the one always bringing up budgets and goals?

These tendencies come from early life experiences, family influences, and your personal financial journey. Recognizing your patterns is the first step to building a healthier, more intentional relationship with money.

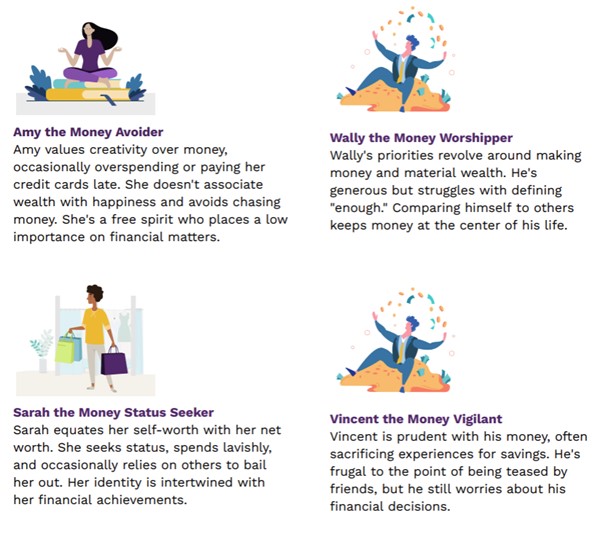

Common Money Scripts

Money scripts are beliefs that shape your relationship with money and often stem from your childhood experiences. Here are four distinct money scripts many people fall into:

Take the Test: Discover Your Money Personality

Want to gain deeper insights into your financial tendencies? Try one of these tests:

- Morningstar’s Investor Personality Test: Uncover your investment style and risk tolerance.

- Dave Ramsey’s Financial Personality Quiz: Find out how your habits align with your financial goals.

- Money Mindset Quiz: Discover Your Relationship with Money

Once you’ve taken one or more of these quizzes, reflect on the results. Are you surprised? Do they confirm what you already suspected? This awareness is key to improving your relationship with money.

Plan for Success in 2025

Like any great relationship, your connection to money takes time, effort, and reflection to grow. Here are five tips to help you develop a healthier, more intentional relationship:

1. Check In Regularly

Think of your finances like a long-term relationship that needs regular attention. Set a time each month to sit down with your budget, review your spending, and check on your financial goals.

Ask yourself: Are you staying on track? What adjustments need to be made? Treat it like a “money date” to keep things light and intentional.

2. Define Your Financial Goals

It’s hard to improve your relationship with money if you don’t know what you’re working toward. Take time to define both short- and long-term goals. These might include:

- Saving for a family vacation

- Paying off debt

- Building a six-month emergency fund

- Investing for retirement

Having clear goals gives you direction and helps you make better decisions in the moment.

3. Identify Emotional Triggers

We’ve all been there: A stressful day leads to online shopping, or a sense of scarcity pushes us to hoard money without enjoying it.

Pay attention to your emotional triggers. Ask yourself: What situations make you overspend or avoid financial decisions? Once you’ve identified these patterns, you can develop healthier responses.

4. Celebrate Small Wins

Building a better relationship with money is a process, and every step forward is worth celebrating. Did you pay off a credit card? Stick to your budget for the month? Celebrate! These small victories keep you motivated and help you maintain positive momentum.

Love Your Money, Love Your Life

Just like any relationship, your connection to money needs care and attention. This Valentine’s month, take some time to reflect on where you are and where you want to be.

With the right mindset and tools, you can build a relationship with money that supports your life—not one that controls it.

So, give your finances a little love. Your future self will thank you.

Disclosure: Tradewinds, LLC is an investment adviser registered under the Investment Advisers Act of 1940. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Tradewinds cannot guarantee the accuracy of the information received from third parties. The opinions expressed herein are those of Tradewinds and may not actually come to pass.