There are people out there who love doing their taxes. Who get joy from filling in boxes and checking things off. And for the lucky ones, there’s the thrill of seeing their refund get calculated – like watching a slot machine spin and hoping you hit the jackpot.

Then there’s the rest of us. For whom the best part of tax season is that shining moment when we hit submit, and don’t have to think about it again for another calendar year.

But as filing time looms large, doing our taxes is an unavoidable part of adulting. We all know the saying about death and taxes! Read on for helpful info and pointers to make the process as productive and painless as possible.

Tax Terms 101

W-2 Form

Your W-2 tax reports the income you’ve earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other important info for the year. Use this form to file your federal and state taxes.

Tax Deduction

The amount you can deduct from your taxable income to lower the amount of taxes that you owe. You can choose the standard deduction—a single deduction of a fixed amount—or itemize deductions on Schedule A of your income tax return. If the total for your itemized expenses is greater than the standard deduction for your filing status, it’s wise to itemize. Allowable itemized deductions include mortgage interest, charitable gifts, unreimbursed medical expenses, and state and local taxes

State Taxes

Live in one of the 42 U.S. states that collect state income taxes? Then you may already know that state taxes are being withheld from your paycheck alongside federal income tax. Though filing deadlines and procedures can vary, typically you’ll file state income taxes once a year when you file your federal taxes to report your income, claim deductions and credits, and either pay the taxes you owe or receive a refund

Federal Taxes

The IRS oversees federal income taxes, which are calculated using a progressive system of marginal tax rates and brackets. In plain English, this means your income is taxed at progressively higher rates as it increases.

Why Do We Pay Taxes?

A lot of folks in our country gripe about the money taken out of their paychecks. But how often do we pause to reflect on the privileges these deductions afford? The money we pay in taxes goes to many places. In addition to paying the salaries of government workers, our tax dollars also help to support public resources, such as police and firefighters.

Tax money helps ensure the roads we travel on are safe and well-maintained. Taxes fund public libraries and parks. This money also funds lots of government programs that help the poor and underserved, as well as many schools.

What to Remember Before You Hit Submit

IRA Contributions

Have you contributed to your retirement accounts for 2022?

- You have until the filing due date to contribute to your IRA (Traditional and Roth) for the previous year.

- It’s important to start tax-free compounding as soon as you are able so don’t delay in making contributions if possible.

Electronic filing

If possible, file your taxes electronically, especially if you’re expecting a refund.

- The IRS processes electronic returns faster than paper ones.

Because of this, you can expect to get your refund 3 to 6 weeks earlier.

Having your return set up to deposit electronically can shave weeks off your processing time. - Did you know that less than 1% of electronically filed returns have errors, compared to 20% of paper returns? That’s a pretty significant difference.

- Also, the IRS acknowledges the receipt of your return. How thoughtful of them!

Rethink your filing status

When determining your filing status (single, qualified widower with dependent child, head of household, married filing separately, or married filing jointly) it can pay off to try mixing things up.

- For most married couples it makes sense to file jointly – BUT – if one of you has significantly more income than the other, or one person had a ton of medical bills or other deductible expenses last year, then it could be beneficial to file separately.

- If you aren’t married, but you have children or other dependents (including an elderly or disabled relative for whom you provide at least 50% of the financial support) than you can file as head of household (vs. single), which will result in a significantly larger standard deduction and a lower tax rate as well.

- On the fence which way to go? The best way to find out is to fill out your tax information both ways using a tax prep software program (without actually submitting your return) and see which filing status results in the biggest refund.

Standard vs. Itemized Deductions

It is easier to take the standard deduction, which for a single taxpayer in 2022 is $12,950 and married filing jointly is $25,900, but if your qualifying expenses add up to more than the standard deduction then it may be worth it to itemize in order to take advantage of the savings.

There are lots of popular tax deductions out there, but here are some of the most common:

- Retirement account contributions

- Educational expenses

- Medical bills (you can deduct the portion of medical expenses that exceed 7.5% of your adjusted gross income)

- Property taxes and mortgage interest

- Charitable donations

Provide dependent taxpayer IDs

If you want the IRS to allow you any dependent credits, make sure you provide your children and other dependents’ tax ID (social security number).

- Fail to do so and you may not get those credits you are expecting, like the Child Tax Credit.

- Note that if you are divorced, only one parent can claim your children as dependents and receive that deduction.

Why Must We File By?

FEDERAL DEADLINE

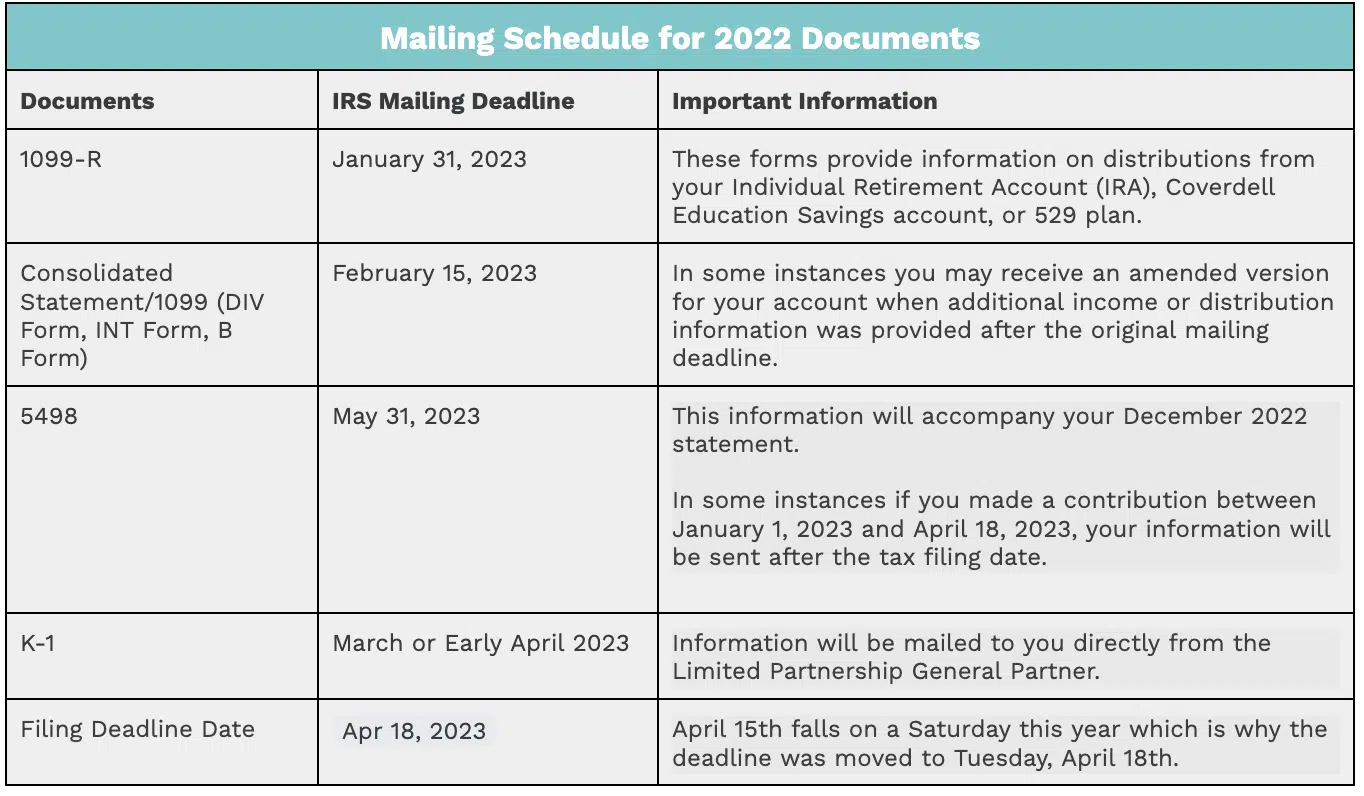

This year, the deadline for filing federal income taxes is April 18, 2023, instead of April 15. We can thank the Emancipation Day holiday in the District of Columbia for these three extra days!

The IRS begins accepting and processing federal tax returns on January 23, 2023. To get your tax return started, you’ll first need to find out how much money you made in 2022. Then you’ll need to decide whether to take the standard deduction or itemize your return. Finally, you’ll need to submit it all by April 18, 2023.

STATE & LOCAL RETURNS

Most states followed the lead of the IRS and made their tax deadlines April 18, but some have imposed a slightly later deadline. To make sure you file these on time, find out the tax filing due dates in your state. If you owe money and don’t file and pay your tax bill on time, you’ll be charged interest and a late payment penalty – yikes! But it’s interesting to note: if you are owed a refund, there’s no penalty for filing a late return.

For a Deeper Dive

There is a plethora of tax info out there on the interwebs – it can be overwhelming!

Here are helpful resources you can trust:

Of course, our pointers are just a primer. Be sure to consult with your tax advisor for all the rules and responsibilities that pertain to you.

Happy Filing to all. Here’s to hitting that submit button!

Onwards with Optimism, The TradeWinds team

—

Have a friend or colleague who you think would be interested in Money Courage? They can sign up here.